Erstklassiger IPTV-Anbieter und die Nr. 1 in Deutschland – weit bekannt und voll vertrauenswürdig

Kaufe IPTV in Deutschland beim besten IPTV-Anbieter und genieße über 26.000 internationale Sender, Filme und Serien. Premium IPTV-Service mit allen Sendern und stabiler 4K-Streaming-Qualität

Smart 4k IPTV Abonnement

Warum sollten Sie sich für unsere 4K-IPTV-Abonnements entscheiden?

Wir möchten Ihr Unterhaltungserlebnis mit außergewöhnlichen IPTV-Abonnementdiensten revolutionieren, die Ihre Erwartungen übertreffen sollen.

Stabilität und Qualität

High-quality IPTV server with a 20 Gbps connection. Most of our channels are available in 4K and Full HD quality.

Zufrieden oder Geld Zurück

Wir bieten eine 15-tägige Geld-zurück-Garantie, wenn Sie mit unserem äußerst zuverlässigen 4k IPTV -Dienst nicht zufrieden sind.

VIP-Unterstützung 24/7

Unser IPTV-Support ist rund um die Uhr für Sie da. Kontaktieren Sie uns einfach und wir beantworten Ihre Fragen!

Ihr Abonnement

Ein entscheidender Fakt: Unsere Preise sind die besten auf dem Streaming-Markt – im Vergleich zu dem Service und der Qualität, die wir bieten

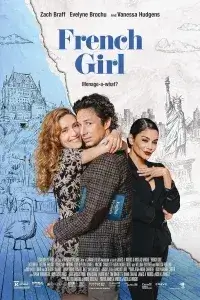

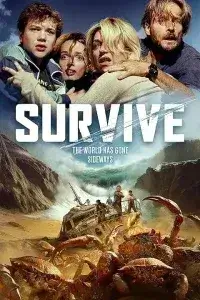

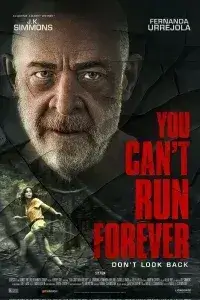

4K IPTV bietet alle aktuellen Filme und Kinofilme

+7K

Zufriedener Kunde

30K

Kanäle

40K

Filme und Serien

3K

Sportkanäle

Funktioniert auf allen Ihren Geräten – genießen Sie erstklassiges Streaming in 4K-IPTV-Qualität

Ob auf einem Smart TV, Fire Stick oder Mobilgerät, unser deutsches 4K IPTV sorgt für reibungsloses, hochauflösendes Streaming mit voller Kompatibilität

Häufig Gestellte Fragen :

There are couple of ways:

● Obtain tax residency on the basis of being a high net worth individual.

● You may stay in CA for any 183 days within 12 months period;

● Obtain tax residency on the basis of being a high net worth individual.

● You may stay in CA for any 183 days within 12 months period;

The status of international company may be granted to a CA enterprise in any of the following cases:

a) if the enterprise has at least two years of experience in carrying out the permitted activities, on the basis of which it applies to obtain the status;

b) if the enterprise is a representative of a non-resident enterprise, which has at least two years of experience in the permitted activities.

Virtual Zone Entity (VZE) is an LLC or JSC which is registered in CA, which provides Information Technology (IT) services abroad and gets the status from CA authorities.

Under Information Technology, CA tax code defines following activities: the study, support, development, design, production, and implementation of computer information systems, as a result of which software products are obtained.

VZEs are fully exempt from Corporate Income Tax on profit that the company gets from provision of Information Technologies (services) outside of CA; They are fully exempt from VAT on provision of Information Technologies outside of CA. As a result, normally, companies pay only 5% dividend tax on the dividends distributed to the shareholder. And that’s it.

VZEs are fully exempt from Corporate Income Tax on profit that the company gets from provision of Information Technologies (services) outside of CA; They are fully exempt from VAT on provision of Information Technologies outside of CA. As a result, normally, companies pay only 5% dividend tax on the dividends distributed to the shareholder. And that’s it.

Virtual Zone Entity (VZE) is an LLC or JSC which is registered in CA, which provides Information Technology (IT) services abroad and gets the status from CA authorities.

Under Information Technology, CA tax code defines following activities: the study, support, development, design, production, and implementation of computer information systems, as a result of which software products are obtained.

There are couple of ways:

● You may stay in CA for any 183 days within 12 months period;

● Obtain tax residency on the basis of being a high net worth individual.

The status of international company may be granted to a CA enterprise in any of the following cases:

a) if the enterprise has at least two years of experience in carrying out the permitted activities, on the basis of which it applies to obtain the status;

b) if the enterprise is a representative of a non-resident enterprise, which has at least two years of experience in the permitted activities.